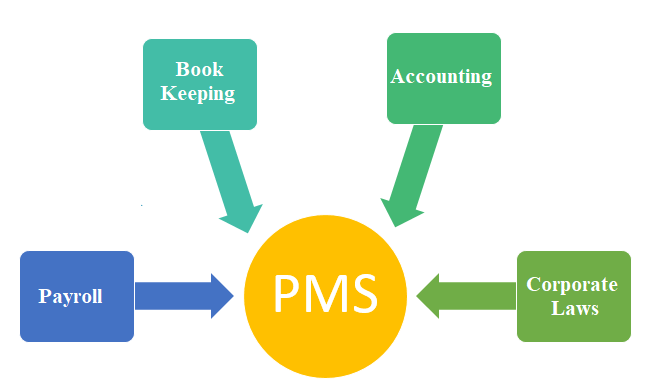

Portfolio Managed Services

Governance and compliance management are two important facets of business entities in India or abroad. Governments are working with higher determination to induce higher transparency, increased governance and leak proof taxation system in to the corporate world and this is leading to rapid evolution in multiple Corporate Laws in India.

Therefore, an organisation needs to be much more compliant and vigilant in ensuring various compliance requirements under these evolving Corporate Laws. Any slightest deviation, may put the Company, its Directors, key managerial personnel and officers to a penal risk or other unintended consequences.

Our team of Professionals not only will ensure that your organization is fully compliant with these various Regulations but also devise effective tools and preparedness for day-to-day and upcoming challenges.

In case you require any customized requirements, never worry we would surely help you, as we appreciate your needs and adjust the deliverables to such specific requisition.

Depending on your needs, our scope of services can include following Statutes, Regulations or domains:

Corporate Laws

- Companies Act

- SEBI Regulations and listing guidelines

- Public issue through IPO

- FEMA and RBI guidelines

- Intellectual Property Regulations

- Labour Laws including Provident Fund (PF), ESI, PF, Shops & Establishment License etc

- Industry specific Regulations viz. Pollution Laws etc

- - Other domains as per specific requisition

Accounting and Book keeping

- Accounting and book keeping

- TDS and TCS management under Income Tax

- Income tax, GST

- Assist in Audits (Tax audit, Transfer pricing audit, GST Audit, Statutory audit)

- Tax Due diligence

Payroll

- Payroll processing

- PF, ESI, PT contribution

- TDS payment and return filing

- Form 16 generation

- Tax efficient salary structuring

- Compensation breakup design

- Full and final settlement calculation

- Regulatory registrations for above

- Bonus and Gratuity calculation

- Gratuity trust formation